Rates shown are based on a conforming first lien purchase mortgage loan amount of 175 000 for a single family owner occupied residence with a maximum loan to value ratio of 75 a 0 25 interest rate discount 1 2 for a qualified client with eligible keybank checking and savings or investment accounts mortgage rate lock period of 60 days.

Key bank refinance mortgage rates.

Keybank s mortgage options include conventional fixed rate and adjustable rate mortgages fha va jumbo combination key community mortgages mortgages for medical professionals and state bond loans.

Low and moderate income households can qualify for a loan with no down payment and no private mortgage insurance keybank also accepts nontraditional credit histories with this loan.

Monthly payments on a 15 year fixed refinance at that rate will cost around 663 per.

This bank profile is not an endorsement or advertisement for the bank s products and services.

Rates shown are based on a conforming first lien position rate and term refinance mortgage loan amount of 175 000 for a single family owner occupied residence with a maximum loan to value ratio of 75 a 0 25 interest rate discount 1 2 for a qualified client with eligible keybank checking and savings or investment accounts mortgage rate lock period of 90 days an excellent credit profile including a fico score of 740 or higher and a debt to income ratio of 36 or lower.

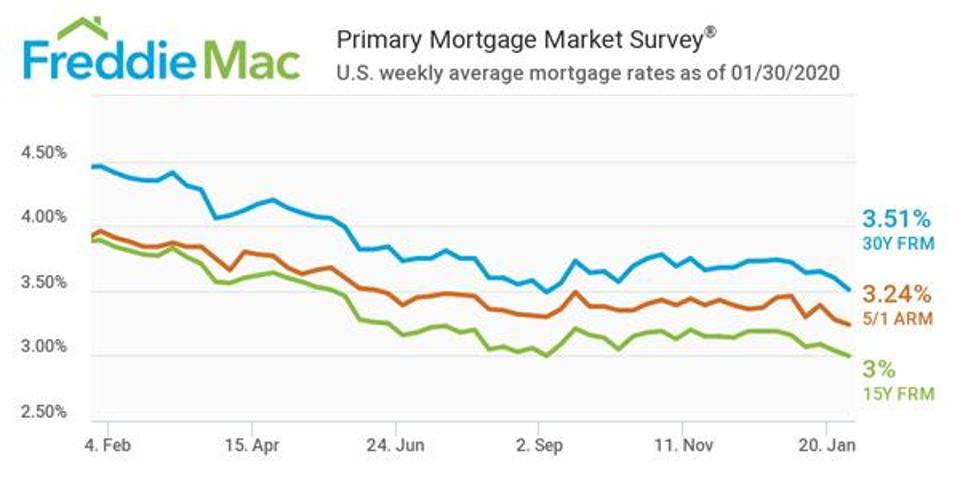

Key s mortgage division offers a variety of residential mortgage products including 15 and 30 yr fixed and 5 1 arm.

Key private bank clients wealth management clients with a high net worth can qualify for a loan of up to 3 5 million with no pmi.